Welcome to American Funds Online Group Investments

You’ve made it easy for your employees to save. Let us make your contribution process just as easy by registering for online group investments today.

Managing your employer-sponsored plan online is:

Fast

- Managing your plan in just minutes and free up time for other important tasks.

- Put assets to work sooner by making investments directly from your bank account.

Safe

- Know that your employee data is fully encrypted and secure.

- Avoid unnecessary security risks from lost or mishandled mail.

Convenient

- Service your plan whenever you want.

- Send electronic submissions to eliminate paperwork and postage.

Site Features

- Review Recent Activity

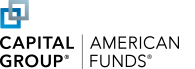

-

Roster history gives you an at-a-glance view of your contribution history for the past 18 months. You can review the status and contribution details of previously submitted rosters or return to a saved work-in-progress roster at the click of a button.

- Enter New Contributions Manually

-

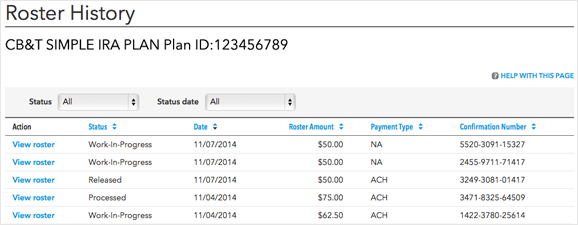

Submit a payroll contribution in a few easy steps:

- Enter a trade date (optional).

- Specify the contribution year, if applicable.

- Input contribution amounts.

- Verify and submit.

- Upload a Payroll Contribution Spreadsheet

-

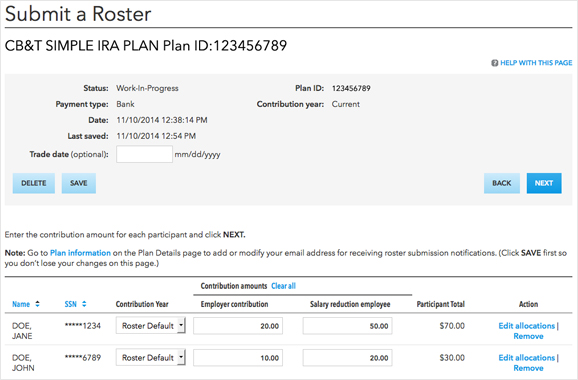

You can also submit contributions by importing a spreadsheet.

- Format your own spreadsheet (see image below) or use the default roster template available online.

- Upload the completed file to streamline your process.

- Update Plan Information

-

Easily update email and mailing addresses, bank information or participant fund allocations for your plan. Also, once you’ve logged into the website, you’ll have access to the Online Group Investments User Guide. This guide provides a combination of visuals and step-by-step instructions for each section of the website.